- Beschreibung

-

Einzelheiten

Funktionen

Live-Validierung während der Eingabe

Validiert alle EU-Umsatzsteuernummern im VIES (VAT Information Exchange System). Offline-Validierung der Nummern auf syntaktische Korrektheit.

Benutzerfreundlich und fehlerreduzierend

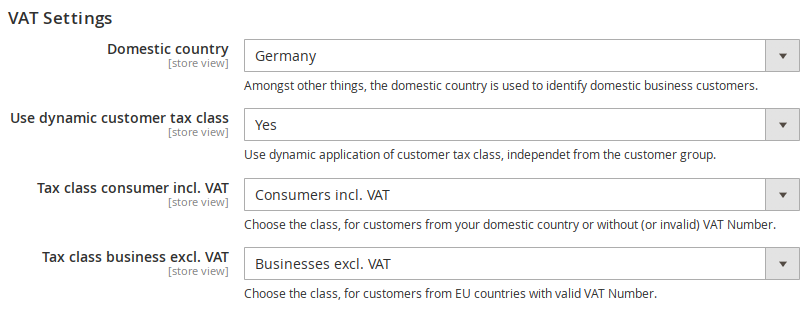

Dynamische Kundensteuerklasse

Du musst Kunden nicht mehr speziellen "ohne Steuer"-Gruppen zuordnen. Die Erweiterung wendet die Steuerklasse gemäß den gemeinsamen Anwendungsfällen an, die wir mit dir (unseren Kunden) auf der Grundlage der Kundenadresse und der Validierungsdaten ausgearbeitet haben.

Damit kannst du Fälle verwalten, die von Magento Core nicht unterstützt werden.

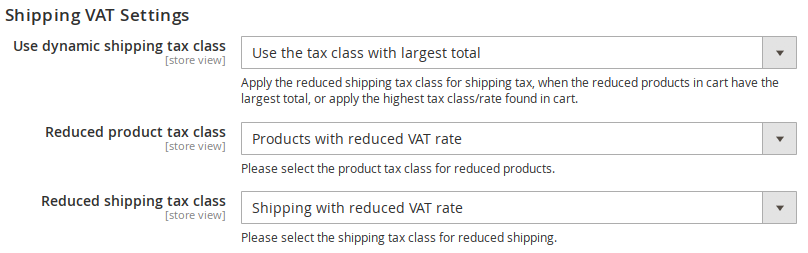

Dynamische Versandsteuerklasse

Du kannst die Methode zur Berechnung des reduzierten Mehrwertsteuersatzes auswählen, wenn dein Warenkorb nur reduzierte Produkte enthält oder wenn der Gesamtwert der reduzierten Produkte den Großteil des Warenkorbwerts ausmacht.

Fügt mehr Optionen für die Berechnung des Versandsteuersatzes hinzu.

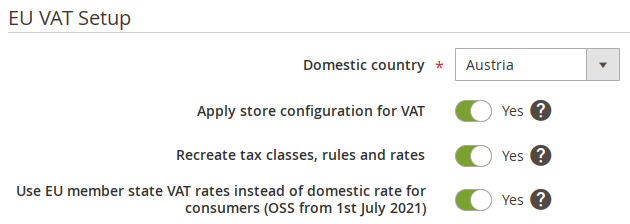

Automatisierte Einrichtung

Richte schnell Steuerklassen, Steuersätze und Steuerregeln ein, indem du die Standardsteuersätze verwendest und sie in Magento konfigurierst.

Das spart dir viel Klickarbeit, wenn du ein neues Projekt beginnst.

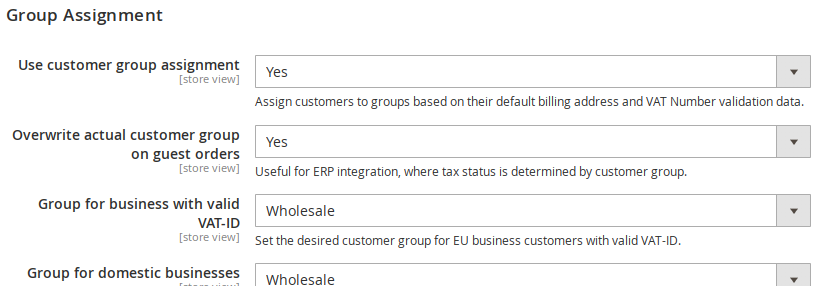

Kundengruppenzuordnung

Automatische Zuordnung zu den folgenden Kundengruppen:

B2C Allgemein, B2B in Europa, B2B Inland, B2B/B2C International, Ungültige USt-ID, Technische Fehler

Die Verwendung der Gruppenzuordnung ist optional.

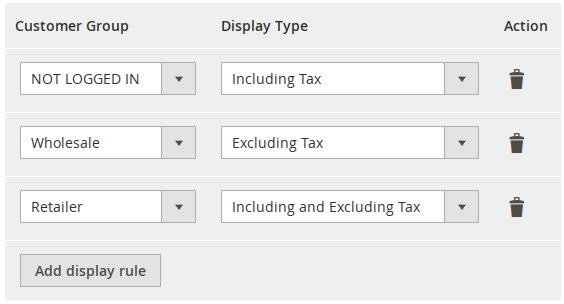

Preisanzeige nach Kundengruppe

Du musst für B2C die Preise inkl. MwSt. anzeigen, für B2B aber ohne MwSt. oder beides?

Mit den flexiblen Einstellungen für die Preisanzeige hast du alles unter Kontrolle.

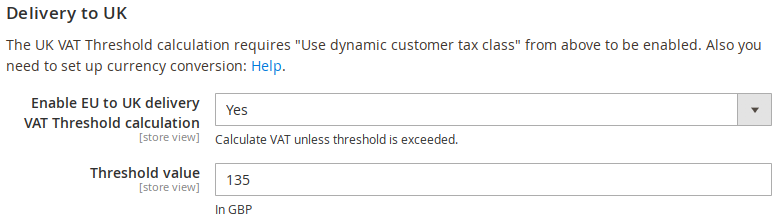

Brexit-Unterstützung

Wenn du nach Großbritannien lieferst, musst du wahrscheinlich den Schwellenwert von 135 GBP beachten.

Du kannst die automatische Handhabung der britischen Lieferschwelle mit Währungsumrechnung ganz einfach aktivieren.

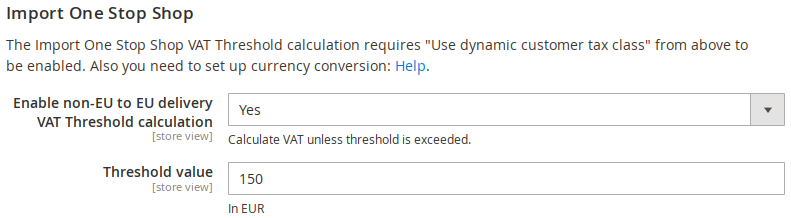

IOSS-Unterstützung

Auch Nicht-EU-Länder, die in die EU liefern, sind abgedeckt.

Du kannst die automatische Handhabung der EU-Lieferschwelle mit Währungsumrechnung ganz einfach aktivieren.

Viele Integrationsmöglichkeiten

Vor allem für Luma-basierte Themen lässt die Erweiterung keine Wünsche offen.

Die Erweiterung ist mit Hyvä Themes kompatibel und unterstützt fast alle Integrationsoptionen.

Weitere Features

- Unterstützt Schwellenländer, wenn du den Mehrwertsteuersatz des Schwellenlandes berechnen musst.

- Mehrwertsteuernummern können über das Frontend für Kunden oder über das Magento-Backend für Verwaltungsbenutzer validiert werden

- Erweitert die Verwaltung der Kundenadressen um weitere Informationen zur Validierung der Umsatzsteuer-Identifikationsnummer, wie z.B. den Firmennamen und die Adressdaten (falls vom jeweiligen Land unterstützt)

Funktioniert mit Checkout-Modulen von Drittanbietern:

- OneStepCheckout (Das Original)

- Aheadworks OneStepCheckout

- Amasty Checkout

- BSS Commerce One Step Checkout

- Mageplaza OneStepCheckout

- Swissuplabs FireCheckout

Anforderungen

- PHP Version 7.1+, PHP-Erweiterung SOAP, PHP-Erweiterung cURL

Haftungsausschluss

Diese Erweiterung nutzt den EU-Dienst VIES (VAT Information Exchange System), um die Umsatzsteuer-IDs deiner Kunden zu validieren. Es kann vorkommen, dass dieser Dienst ausfällt und die Umsatzsteuer-Identifikationsnummern deiner Kunden nicht validiert werden können. In solchen Fällen handelt es sich nicht um eine Störung unseres Moduls und deine Kunden können sich weiterhin in deinem Shop registrieren oder zur Kasse gehen. Der spezielle Haftungsausschluss für das MIAS gilt auch für unser Modul.

Diese Seite und unsere Software stellen keine Steuerberatung dar und sollen lediglich technische Lösungen für allgemeine Probleme mit Geschäftsanforderungen in Magento bieten. Für steuerliche Informationen wende dich bitte an deinen Steuerberater.

- Versionshinweise

-

Versionshinweise

Geissweb_Euvat for Magento 2 Changelog

[1.26.3] 2026-03-01

Added

- Introduce

QuoteContextregistry for improved handling of quotes in sessionless environments (webhooks, API) and integrate it into AddressResolver, CbtProcessor, and related plugins.

[1.26.2] 2026-02-25

Added

- Support for tax free territories: skip VAT validation for special EU zones (e.g. Canary Islands, Helgoland, Åland, Mount Athos)

Fixed

- No requests to our VAT rates API anymore during integration tests or within build/deploy pipelines

[1.26.1] 2026-02-18

Changed

- Seperated Hyvä Checkout compatibility module from the main module again, due to dependency conflicts

[1.26.0] 2026-02-17

Added

- The Price Display By Customer Group feature supports the Shipping Amount too now

Changed

- Incorporated Hyvä Theme compatibility module into the main module, it will now conflict with the Hyva_GeisswebEuvat module

- Incorporated Hyvä Checkout compatibility module into the main module, it will now conflict with the Hyva_GeisswebEuvatCheckout module

Fixed

- TypeError in CbtProcessor class

[1.25.8] 2025-12-29

Changed

- Replaced preferences for

Magento\Customer\Observer\BeforeAddressSaveObserverandMagento\Customer\Observer\AfterAddressSaveObserverwith proper replacement - Refactorings

Fixed

- Translation issue with

The format of the VAT number is invalid for this country. - Invalid number blocks checkout progress although validation is set to

Optional

[1.25.7] 2025-12-10

Added

- Possibility to hide VAT field at billing address

Changed

- Refactor Cross-Border-Trade processing to support tax free EU regions like Canary Islands

Fixed

- Checkbox "same as shipping" will not be unchecked anymore

[1.25.6] 2025-10-20

Changed

- Revision of the CleanVatNumbers command

Fixed

- Added fallback to our VAT rates API

[1.25.5] 2025-09-30

Changed

- Always show actual validation data from addresses in order comments instead of data from vat_validation table

- Bump core module dependencies to >=100.4 to satisfy Adobe Marketplace requirements

Fixed

- Possible type error in CaseIdentifier classes

- Empty tooltip taking up space from the VAT number input field

- Issue with validation result message not visible for Amasty checkout

[1.25.4] 2025-09-08

Changed

- Removed restriction of only allowed countries for selection in system configuration

- Validation request will now use the country prefix from the VAT number of the merchant as the requester country

- HMRC settings now hidden to raise awareness for upcoming removal of this interface

Fixed

- Removed debugging without condition at checkout

- Possible return type error in VatAddressProcessor class

Other

- Minor code maintenance, added some tests, updated links to documentation

[1.25.3] 2025-08-30

Added

- Pro-Rata / Proportional shipping tax calculation

Changed

- Force always online validation at sales order create page

[1.25.2] 2025-08-04

Fixed

- Validation at customer login could throw an exception preventing the login process

- Unit-Tests now fully compatible with PHPUnit 10

- Deprecation notice: Implicitly marking parameter as nullable

[1.25.1] 2025-07-21

Added

- Performance improvement: Index to

vat_idcolumn invat_validationdatabase table

[1.25.0] 2025-07-08

Added

- Order comment for VAT validation now shows the request message additionally

Changed

- Improved retry possibility for users when interface issues occur (timeout, maximum requests reached, etc.)

- Moved syntax validation from frontend JS to backend PHP, to prevent malicious requests to the controller

- Also save failed validation results to be able to show the results in the order comments

Fixed

- Return types of ValidationResultInterface for methods getWarning and getError

- Wrong usage of addErrorMessage within the AutoSetup exception handling

[1.24.7] 2025-05-27

Added

- Additional validation result address handling on checkout

Changed

- Reorder a few system configuration settings, former setting for frontend field validation now also enables/disables backend validation

[1.24.6] 2025-05-20

Changed

- Unified VAT number validation result address handling in a service class, affects observers

Fixed

- Fix uncaught TypeError:

countrySelect.valueis not a function atcustomer/account/createandcustomer/address/edit

[1.24.5] 2025-05-07

Changed

- Deprecate HMRC VAT validation due to request from HMRC as the API may only be used with application based authentication which we can not provide

Fixed

- Greece country prefix at service validator

[1.24.4] 2025-02-20

Added

- New config option to hide the VAT number field on the shipping address

[1.24.3] 2025-02-16

Added

- New config option to allow different VAT number country prefix from address country

Fixed

- Bug with greece country prefix on customer login validation

[1.24.2] 2025-02-05

Changed

- Updated SK tax rate to 23% for Auto Setup

Fixed

- Integration testing

[1.24.1] 2025-01-22

Fixed

- Issue with expecting variable on PHP7.4

[1.24.0] 2025-01-10

Added

- Determination method of the customer tax class is now configurable to use the VAT ID number of either the billing or shipping address (before only billing address was supported)

[1.23.0] 2024-12-09

Added

- Retry mechanism for VIES validation with exponential backoff

- Compatibility with Xtento_CustomAttributes at Adminhtml sales order create

Changed

- Improved extendability for custom tax case implementations with the CaseIdentifier class

- Smaller refactoring of validation classes

- Service validation URLs are now configurable

- Removed some excessive logging for better readability of the log

[1.22.1] 2024-11-06

Fixed

- Company name was not saved at customer address edit when using disable option on overwrite company name

[1.22.0] 2024-11-04

Added

- Support for new HMRC authentication requirement from January 2025 for GB VAT number validation

- Console command

geissweb:selftest:vatcalcto check the application of tax rates depending on the supported tax cases according to the current configuration.

[1.21.5] 2024-10-07

Changed/Fixed

- Make use of SecureHtmlRenderer, fixes validation at adminhtml sales order create

[1.21.4] 2024-10-06

Added

- Local storage validation results cache for Luma checkout

Changed

- Renamed "Periodic Revalidation" to "Validation Result Cache" for clarification

Fixed

- Stuck loading issue when no shipping method was selected

[1.21.3] 2024-06-27

Fixed

- Totals reloading after VAT number was removed

- Ensure compatibility with PHP7.4

- Insecure unserialize call removed for Aheadworks Checkout compatibility

[1.21.2] 2024-03-29

Added

- Similar to the overwrite guest customer group option, a new option was added to overwrite the customer group for registered customers without default addresses

Changed

- Allow all countries as domestic country in configuration

- Allow all countries for net price calculation configuration

- Allow all countries for always including VAT configuration

- Do only use EU countries for extended validation, use simple validation otherwise

- Removed setup support for digital products, which are treated just like physical products in the meantime

- Improved total reloading mechanism at checkout

Fixed

- Auto-Setup feature did not create tax rules

- A few German translations

- Replace deprecated method calls like addNoticeMessage instead of addNotice

- Only update company field value if data exists

[1.21.1] 2024-02-20

Added

- Translations for CZ, GR, EE, FI, HU, LT, LV, PL, RO, SK, SL, SE

Changed

- Renewed translations for DE, ES, FR, IT, NL, PT

Fixed

- Avoid "Area code is not set"

- Adminhtml sales order create, updated messages especially for group assignment

[1.19.4] 2024-02-20

Fixed

- Ensure compatibility with PHP 7.3 and Magento 2.3.7

[1.21.0] 2024-01-19

Added

- New experimental feature to force use the company name from the interface response for the address data

Changed

- Updated compatibility with

BSS B2B Registration module - Updated VAT rates for 2024 for the Auto-Setup (existing installations need to manually update the rates)

[1.20.10.1] 2023-12-19

Fixed

- Possible type error in BeforeAddressSaveObserver

[1.20.10] 2023-12-11

Fixed

- Undefined "dataScopePrefix" for Adobe Commerce (Cloud) with Braintree module

- Form validation issue

[1.20.9] 2023-10-18

Added

- BE VAT numbers can now have a 1 as starting number for the offline validation and regex check

[1.20.8] 2023-10-09

Fixed

- VAT field not working on customer address edit page

[1.20.7] 2023-09-22

Fixed

- VAT field missing in auto setup form

[1.20.6] 2023-08-31

Changed

- Class

Geissweb\Euvat\Block\Vatfieldnow utilizes JS Layout properly - Removed some unused code

- Adjust layout for Mageplaza Checkout

Fixed

- Some smaller issues

- Silenced

NoSuchEntityExceptioninGeissweb\Euvat\Plugin\Tax\Calculation

[1.20.5] 2023-06-23

Changed

- Improved compatibility with Amasty Checkout

[1.20.4] 2023-06-20

Added

- Aheadworks Checkout integration revised to support sort order of fields

- Dynamic shipping tax class supports bundle products

- Country prefix validation added to CaseIdentifier

Fixed

- HMRC Validation result is always the one from requester number

- Issue after frontend country correction when new country is not visible but valid VAT is required

[1.20.3] 2023-05-26

Added

- Now supports using the default customer addresses for tax calculation with the revised tax class identifier

[1.20.2] 2023-05-22

Fixed

- Issue with Mageworx Ordergrid extension

- Error calling getCountryId method on bool

[1.20.1] 2023-05-04

Fixed

- Type error in Geissweb\Euvat\Model\CaseIdentifier

[1.20.0] 2023-05-01

Important

This release introduces changes on the handled tax cases for the dynamic customer tax class feature. With this version the feature does not only consider the shipping address to evaluate which customer tax class to apply, instead it evaluates now both addresses, whereby the shipping address does only play a role when deciding which tax rate is applied.

Changed

- Optimized dynamic customer tax class feature to cover more tax cases

- A lot of code quality improvements, PHPCS Level 6, PHPStan Level 6

- PHP7.4 and Magento 2.3.7 are now the minimal required versions

- Removed custom address templates at checkout, because the default templates include the VAT number in the meantime

[1.19.3] 2023-03-18

Fixed

- Dependency on Aheadworks\OneStepCheckout\Model\Config

- Show VAT number validation result in adminhtml popup

[1.19.2] 2023-03-16

Fixed

- Compatibility with Aheadworks Checkout 2.4

- Avoid conflicts with getRequest method in validation controller

- Deprecated functionality: Implicit conversion from float-string

- getByVatId with empty string

Changed

- Refactoring of KnockoutJS components

[1.19.1] 2022-11-20

Fixed

- Checkout issue with self-closing tag

- VAT number validation on order create in admin area

Changed

- Removed VAT Trader Name and Address from order create in admin area

[1.19.0] 2022-10-31

Added

- Option to disable validation for specific countries

- Option to force revalidation of invalid numbers

Changed

- Smaller refactoring

- Empty validation results (without VAT number) are not saved anymore to the database

[1.18.2] 2022-10-06

Fixed

- Missing dataScopePrefix on EE/Adobe Commerce

- Broken tooltip when empty

- Admin validation

Changed

- Don't log exception on expired cart

- Disabled trigger_recollect workaround from Magento 2.1 times

[1.18.1] 2022-09-02

Fixed

- Fixed issue with backend reorder with no customer id

- Fixed issue with validation not possible on Porto theme

[1.18.0] 2022-08-04

Added

- Possibility to use dynamic shipping calculation for custom cron processing

- Option to disable Cross-Border-Trade for UK delivery threshold

- Day and Week options for the revalidation period

Changed

- Refactor frontend validation controller to use GET requests to avoid data loss in checkout

- Removed vatfield.css in favor of _module.less

- VAT numbers will not be validated again on manual page reload at checkout

Fixed

- Prevent deprecated message for PHP8.1

- Issue with disable Cross-Border-Trade for non-EU

[1.17.8] 2022-06-21

Fixed

- Bug with disable CBT for valid VAT numbers when disable CBT for non-EU countries is enabled

[1.17.7] 2022-06-20

Improved

- Compatibility with Aheadworks checkout

Fixed

- Disappearing address form when customer asked for country change

- Possible "dataScopePrefix error" for the shipping address (Adobe Commerce only)

- Checkout address template display (company and vat_id fields) for M2.4.4

[1.17.6] 2022-06-03

Added

- Option to include shipping cost in threshold calculation

Fixed

- Error with customer API login token (undefined method)

[1.17.5] 2022-05-23

Fixed

- Unwanted logging

[1.17.4] 2022-05-19

Fixed

- Bug on sales order create VAT validation

- Type error during login

[1.17.3] 2022-04-22

Fixed

- Bug with wrong return type

[1.17.2] 2022-04-19

Fixed

- Passing null to explode is deprecated error

[1.17.1] 2022-04-13

- Compatibility with Magento 2.4.4

Changed

- Debug logging method to work around different method signatures of monolog/logger accross different Magento versions

[1.17.0] 2022-03-29

Changed

- Replaced setup scripts with data patches

- Minimum required Magento version 2.3.0

[1.16.11] 2022-02-22

Added

- Reload checkout summary at shipping step after VAT number validation

Changed

- Rename Threshold countries to customer countries rate net price

Fixed

- Issue with "disable CBT for non-EU" when shipping to UK and threshold is exceeded

- Regular expressions for GB, IE, LT and NL (Thanks to Gumax BV)

- Some issues with Aheadworks Checkout

[1.16.10] 2022-01-18

Added

- Basic technical support report, helps to avoid questions regarding your configuration when it comes to support

[1.16.9] 2022-01-07

Added

- Option to enable "As low as" price fix workaround for catalog pages (see https://github.com/magento/magento2/issues/13282)

[1.16.8] 2021-12-09

Fixed

- Fix bug with dynamic shipping tax class dependent on the order of products added to cart when based on the largest row total

[1.16.7] 2021-11-26

Improvements

- Possibility to make adjustments to the VAT field functionality more easy with a custom module

[1.16.6] 2021-11-23

Improvements

- Updated checkout address templates improve compatibility with Amasty Customer Attributes

[1.16.5.2] 2021-11-03

Fixed

- Issue with NI considered as EU country when using IOSS scheme

[1.16.5.1] 2021-10-19

Fixed

- Bug with AddressInterface missing getter (1.16.5 only)

[1.16.5] 2021-10-18

Improvements

- Reloading for Default, Amasty and Mageplaza Checkout

[1.16.4] 2021-09-08

Improvements

- The "Ask customer for country correction" feature now also checks for country field changes after the VAT number was provided

Fixed

- Issue with dynamic shipping tax class by biggest row total when both tax classes had the same value

- VAT number field at registration is displayed twice

[1.16.3] 2021-08-13

Improvements

- Integration with Firecheckout

[1.16.2] 2021-08-12

Compatibility

- Compatible with Magento 2.4.3

[1.16.1] 2021-08-02

Fixed

- Offline validation fallback not evaluated properly

[1.16.0] 2021-07-14

Added

- Feature to calculate VAT according to the IOSS threshold for non-EU to EU orders

- Autosetup now supports up-to-date OSS VAT standard rates for each EU country

Fixed

- Issue which prevented the loading animation to disappear after the validation was finished

- Issue with Aheadworks checkout when no default shipping method was selected

- Issue on Magento Commerce/Cloud with undefined dataScopePrefix at checkout

[1.15.0] 2021-07-01

Added

- Autosetup supports standard rates for each member state (OSS change from 1st July 2021)

Fixed

- Issue where it was possible to progress to the next checkout step or submit the form without waiting for the validation result of the VAT number

- Issue with website config being used for default scope

- Issue where VAT number persisted although field was empty (value removed)

[1.14.1] 2021-05-30

Fixed

- Bug on adminhtml customer address edit caused by new validation listing component

Other

- Ensure backward compatibility with PHP 7.0 and Magento 2.2

[1.14.0] 2021-05-20

Added

- Possibility to validate GB VAT numbers through HMRC service

- VAT number validations adminhtml grid (revalidate or delete validations manually)

[1.13.2] 2021-04-23

Fixed

- JavaScript uncaught TypeError: base is not a constructor

[1.13.1] 2021-04-15

Added

- VAT field now supports "Material" design option on Mageplaza checkout

Changed

- Allow to set UK Threshold calculation value in storeview configuration instead of only global

Fixed

- Initial field display on Aheadworks checkout

[1.13.0] 2021-04-06

Changed

- "Enable AJAX Validation" config option was replaced with "Enable field functionality". It works as a complete switch whether or not to use all the advanced VAT validation funcitonality on the VAT ID field now.

Fixed

- Issue with Amasty checkout

[1.12.7] 2021-03-26

Changed

- Improved dynamic shipping tax class to better support bundle and configurable items

[1.12.6] 2021-03-24

Changed

- Input field validation refactoring, solves issues with third party checkouts

[1.12.5] 2021-02-23

Added

- Show notice message when trying to validate a GB VAT number

[1.12.4] 2021-02-19

Changed

- Removed billing address VAT number validation from Mageplaza Checkout due to unresolvable issues

Fixed

- Issue with logger on ThresholdCalculator class

[1.12.3] 2021-01-28

Added

- Disable Cross-Border-Trade for non-EU when UK threshold is exceeded too

Fixed

- VAT number form field validation on Mageplaza Checkout

[1.12.2] 2021-01-15

Added

- UK Threshold calculation now supports orders from the admin area

[1.12.1] 2021-01-13

Added

- Validation for XI VAT numbers from Northern Ireland

- Treating Northern Ireland like an EU member state in regards of VAT calculation

Changed

- Adjusted Auto Setup for UK and Northern Ireland

Fixed

- EU VAT number validation when using a GB VAT number as requester number

[1.12.0] 2020-12-21

Added

- Support UK sales threshold due to Brexit (135 GBP)

Changed

- Requires Magento 2.2+ at least from now on

[1.11.0] 2020-12-03

Changed

- Removed support for spanish national numbers

[1.10.1] 2020-12-01

Fixed

- Issue with form validation (when company field is filled)

[1.10.0] 2020-10-23

Fixed

- Disable Cross-Border-Trade for valid VAT numbers when using offline validation fallback

Changed

- Improved integration with B2B registration (BSS extension), no template override needed anymore

- VAT field positioning on registration page

[1.9.5] 2020-10-07

Fixed

- Issue with "no dynamic tax group" when the group should include tax in combination with "disabled cross-border-trade"

[1.9.4] 2020-09-30

Fixed

- Issue with group select can not select "none" value

[1.9.3] 2020-09-29

Changed

- Allow to disable dynamic customer tax class calculation for the "not logged in" customer group

[1.9.2] 2020-09-25

Changed

- Improvements to the console command "geissweb:clean:vatnumbers"

- Improved VAT number automatic formatting

[1.9.1] 2020-09-24

Added

- Add country code to the VAT number if missing on revalidation of VAT numbers at customer login

[1.9.0] 2020-09-18

Added

- Support for Spanish national tax numbers (NIF/CIF/NIE) in the VAT number field

Changed

- Improved validation messages for the admin area VAT number field at customer address edit

- Sales order create VAT field will now add the country prefix if missing

[1.8.10] 2020-09-15

Changed

- Minor refactoring for vat-number-base.js: Return the AJAX promise in validateVatNumber(), extracted new method startValidation()

[1.8.9] 2020-09-15

Fixed

- Issue with wrong tax calculation when using offline validation with the domestic country

[1.8.8.1] 2020-09-14

Fixed

- Issue with Mageplaza checkout

[1.8.8] 2020-09-09

Added

- New form field validation option: Required (accept any value)

Changed

- Uninstall script now removes vattradername and vattraderaddress attributes and columns too

Fixed

- formElement configuration parameter is required

[1.8.7.4] 2020-08-28

Changed

- System configuration country multiselect fields allow to select [-- None --]

[1.8.7.3] 2020-08-28

Added

- Reloading of shipping methods after VAT number validation for Amasty Checkout

[1.8.7.2] 2020-08-28

Fixed

- getCompany function

[1.8.7.1] 2020-08-27

Fixed

- updateCountry and _ruleValidVat functions

[1.8.7] 2020-08-26

Fixed

- Visibility issue with VAT field on customer address edit page

[1.8.6] 2020-08-05

Changed

- More refactoring

[1.8.5] 2020-08-03

Fixed

- Area code not set in console command

[1.8.4] 2020-07-29

Added

- Console command to clear invalid VAT numbers from customer addresses

Fixed

- Issue with form field validation on Amasty checkout

[1.8.3.5] 2020-07-10

Changed

- Further strengthened the requirement of a valid VAT number at checkout for existing addresses

[1.8.3.4] 2020-07-07

Added

- Handling for static customer group tax class while creating admin orders

[1.8.3.3] 2020-07-01

Fixed

- Fixed typo in checkout validation

[1.8.3.2] 2020-07-01

Changed

- When a valid VAT number is required for checkout, allow non-EU countries to complete the order without VAT number

[1.8.3.1] 2020-06-26

Added

- Frontend translation for the new checkout validation message

[1.8.3] 2020-06-26

Changed

- Additional validation for existing addresses, when a valid VAT number is required on checkout

- Refactor of OrderManagementInterface Plugin to remove usage of deprecated method

[1.8.2] 2020-06-25

Fixed

- Issue with checkout field validation when the field was not visible

[1.8.1] 2020-06-11

Fixed

- Bug when validating VAT numbers at the sales create order screen

- Reloading spinner loop at Mageplaza checkout when no shipping method is selected

[1.8.0] 2020-06-09

Changed

- Dynamic shipping tax class now supports up to three different classes (default/reduced/super reduced or zero)

[1.7.1] 2020-05-14

Changed

- Integration with Aheadworks Checkout, dropped support for versions below 1.7 for Aheadworks Checkout

[1.7.0.2] 2020-04-09

Changed

- Refactor of system config for field visibility by country

[1.7.0.1] 2020-04-06

Fixed

- Adminhtml Address Form compatibility 2.2/2.3.1

[1.7.0] 2020-04-05

Changed

- Improved validation flow, better utilizing the offline fallback and reuse of existing validations

- Refactoring

[1.6.0] 2020-02-24

Added

- Support for the new NL VAT number syntax

Changed

- Refactored field visibility, to allow to use the VAT field for non-EU numbers too

[1.5.2] 2020-02-14

Fixed

- Wrong configuration scope for adminhtml orders

[1.5.1] 2020-02-04

Added

- New field validation option to require a valid VAT number when the company field is filled

Changed

- New dedicated configuration options for the domestic country and the merchant VAT number

[1.5.0.1] 2020-01-16

Added

- Improved field positioning at registration and customer address edit

Fixed

- Double trader information fields in adminhtml

Removed

- Specialized JS integration for Amasty Checkout module (not needed anymore)

[1.5.0] 2019-11-22

Added

- Offline validation fallback with syntax check, applicable to selected countries

- Price display by customer group for "Cart Prices" and "Cart Subtotal"

Changed

- Some refactoring

[1.4.1] 2019-10-21

Added

- Option to create tax rates (domestic rate) for non-EU countries while using the automatic setup

Fixed

- Country prefix autocomplete for Greece

- Fixed missing dependency for Magento\Tax\Model\Calculation

[1.4.0.1] 2019-09-27

Fixed

- Compatibility with Magento 2.1.x and JSON decode

[1.4.0] 2019-09-12

Added

- Option to always calculate VAT for selected countries, even with a valid VAT number

- Net VAT calculation works with threshold countries

[1.3.11] 2019-08-16

Changed

- Admin validation on create order now uses store specific configuration

- Frontend AJAX validation now supports store code in URL properly

[1.3.10] 2019-07-29

Added

- Checkout field visibility now respects address type of parentscope

[1.3.9] 2019-07-18

Fixed

- Possible checkout error when company or vatid is missing on the address

- Possible group change confirm window loop

[1.3.8] 2019-07-10

Changed

- Total reloading with Mageplaza Checkout

- Removed FIeldsetCompatibility class

- Read own version from composer.json

Fixed

- Issue with PayPal Captcha

[1.3.7] 2019-07-02

Added

- VAT number validation data is saved to quote and order addresses

[1.3.6.1] 2019-06-10

Changed

- Code cleanup

[1.3.6] 2019-06-10

Changed

- Improved admin VAT validation on customer address edit page

- Totals reloading process at checkout

[1.3.5.5] 2019-05-20

Changed

- Fixed issue with JS baseUrl

[1.3.5.4] 2019-05-15

Changed

- Magento coding standard adjustments

Fixed

- Infinite loop when using dynamic shipping tax class

[1.3.5.3] 2019-05-06

Changed

- Removed dependency on \Magento\Framework\App\Helper\AbstractHelper

[1.3.5.2] 2019-04-30

Changed

- Use requester country from VAT number if present

[1.3.5.1] 2019-04-08

Changed

- Compatibility with MagePlaza Checkout

- Compatibility with Magerun2, fixes customer:change-password command (Thanks to Alexander Menk)

- Magento_Checkout/js/model/cart/totals-processor/default::estimateTotals is executed after VAT number validation

[1.3.5] 2019-03-31

Changed

- Adminhtml Customer Adress Edit VAT number validation (compatible with Magento 2.3.1)

[1.3.4] 2019-02-07

Added

- Consideration of existing VAT number on cart estimate block

- Company name and VAT number rendering at all checkout addresses

Changed

- Compatibility with Amasty_Checkout 2.2.0

[1.3.3] 2019-01-19

Fixed

- Fix for the Infinite Loop Fix

[1.3.2] 2019-01-17

Added

- German Adminhtml Translation

Fixed

- Infinite Loop on Collect Totals

[1.3.1] 2018-11-07

Added

- Solution for different tax rates on website level

Fixed

- Dynamic Shipping Tax

[1.3.0] 2018-10-26

Added

- Feature to set catalog price display type per customer group

Fixed

- Performance improvement on the store configuration page

[1.2.3] 2018-10-19

Fixed

- Issue on customer account save

[1.2.2] 2018-10-04

Fixed

- VAT field visibility issue on Aheadworks Checkout

[1.2.1] 2018-10-01

Fixed

- Issue at adminhtmlsalesorder_create for M2.1

- Catalog price display excl. VAT

[1.2.0] 2018-09-04

Added

- adminhtmlsalesorder_create VAT number validation

Fixed

- Bug when changing store currency

- ACL issue

[1.1.0] 2018-08-24

Fixed

- Issue with group assignment when customer creates the initial default address from customer account

- Issue with some themes not considering the JS path mappings correctly (use direct paths in JS components)

[1.0.34] 2018-07-02

Fixed

- Bug with validation on Internet Explorer

Changed

- Ported checkoutsubmitall_after event observer functions to a plugin

[1.0.33] 2018-06-27

Changed

- Compatibility with Mageplaza Checkout

Added

- Support for admin orders with Cross-Border-Trade and Threshold countries

- Support for config checkout/options/displaybillingaddress_on (VAT validation on billing address at checkout)

[1.0.32] 2018-06-19

Changed

- Compatibility with Amasty Checkout

[1.0.31] 2018-06-06

Changed

- Field validation starts after configurable delay

[1.0.30] 2018-05-29

Fixed

- Maintenance and minor Bugfixes

[1.0.29] 2018-05-15

Added

- Possibility to revalidate VAT numbers on customer login within selectable periods

[1.0.28] 2018-05-09

Added

- Possibility to disable dynamic tax class for specified customer groups

[1.0.27] 2018-04-25

Added

- French translation

Changed

- Romania VAT rate to 19%

- Compatibility with Mageplaza Checkout

Fixed

- Empty response at validation

[1.0.26] 2018-01-19

Fixed

- Adminhtml VAT fields

Added

- VAT number in checkout address renderer

[1.0.25] 2018-01-12

Fixed

- AutoSetup product tax class mapping

Changed

- Country code is optional, if address country is present

[1.0.24] 2017-12-21

Added

- Compatibility with Aheadworks OneStepCheckout

Changed

- Mageplaza OSC compatibility

[1.0.23] 2017-12-14

Added

- New validation possibilities at Registration, Checkout and Customer Account (Address)

[1.0.22] - 2017-11-22

Added

- Configurable debug logging

- Optional assignment of customer group on guest orders

Changed

- Reloading process for Magestore Checkout

[1.0.21] - 2017-09-19

Changed

- Refactoring

- Threshold countries can now be all allowed countries

Fixed

- Minor Bugfixes

[1.0.19] - 2017-08-03

Added

- Compatibility with Mageplaza Checkout

[1.0.19] - 2017-07-25

Fixed

- Required VAT number at registration and address edit

[1.0.18] - 2017-06-30

Changed

- Improved customer group assignment function

[1.0.17] - 2017-06-28

Added

- Compatibility with OneStepCheckout (Amasty, Magestore)

[1.0.16] - 2017-05-22

Added

- New shipping VAT algorithm allows to calculate the reduced VAT rate, if cart items have reduced VAT

- Support for Treshold countries when Cross-Border-Trade is used

[1.0.15] - 2017-05-09

Fixed

- Several Bugfixes

Added

- Option to disable Cross-Border-Trade for EU customers with valid VAT number and for worldwide customers outside EU

[1.0.0] - 2017-05-01

Added

- Initial Release

- Introduce

- Roadmap

-

Roadmap

Looking for a specific feature? Just let us know about it at support@geissweb.de